portland or sales tax rate

The sales tax in Portland Oregon is currently 75. This is the total of state county and city sales tax rates.

Cost Of Living In Portland Or 2022 Is Portland Affordable Guide

Rates include state county and city taxes.

. The current sales tax rate in Oregon OR is 0. The December 2020 total local sales tax rate was also 9250. This includes the rates on the state county city and special levels.

The Oregon sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the OR state tax. The Oregon sales tax rate is currently. Sales tax region name.

Exemptions to the Oregon sales tax will vary by state. The 925 sales tax rate in Portland consists of 7 Tennessee state sales tax and 225 Sumner County sales tax. There is no applicable city tax or special tax.

The December 2020 total local sales tax rate was also 8250. 8 will have the choice of whether to approve an increase in the local option sales tax rate and the Portland City Council at its meeting on Oct. There is no applicable city tax or special tax.

2020 rates included for use while preparing your income tax deduction. The average cumulative sales tax rate in Portland Oregon is 0. The Portland sales tax rate is NA.

This is the total of state county and city sales tax rates. Gain on sale of personal property acquired for personal or household use andor. City of Portland Business License Tax rate.

Despite the lack of a state sales. Portland OR Sales Tax Rate. The current total local sales tax rate in Portland TX is 8250.

Portlands local sales tax jurisdictions are made up. Local Sales Tax Range. The Oregon sales tax rate is currently.

Tax rates last updated in January. The Portland sales tax region partially or fully covers 47 zip. You can print a 8 sales tax.

Some rates might be different in Portland. The City of Portland Oregon. Multnomah County Business Income Tax rate.

What state has the highest sales tax. Combined Sales Tax Range. 2020 rates included for use while preparing your income tax deduction.

What is the sales tax rate in Portland Indiana. Portland has parts of it located within Clackamas County. The 8 sales tax rate in Portland consists of 65 Arkansas state sales tax and 15 Ashley County sales tax.

The current total local sales tax rate in Portland TN is 9250. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Portland Indiana is.

The five states with the highest. The latest sales tax rates for cities in Oregon OR state. City Home Government Bureaus Offices of the City of Portland Office of Management Finance Who We Are.

Base State Sales Tax Rate. The County sales tax. Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland Portland Salem Beaverton and Eugene and 102 other cities.

Oregon law doesnt allow you to reduce your Oregon taxes because you paid sales taxes in another state. The sales tax jurisdiction name. Oregons sales tax rates for commonly exempted categories are listed below.

The tax rate is set by the Portland City Council and is currently 1565 per 1000 of assessed value. The Wayfair decision and online sales tax On June 21 2018 the US. The minimum combined 2022 sales tax rate for Portland Oregon is.

This rate includes any state county city and local sales taxes. Oregon is sales tax free and to boot has a lower cost of living compared to the national average. For a commercial property with an assessed value of 500000 the annual.

1 day ago15 min ago. The local sales tax rate in Portland Oregon is 0 as of January 2022. Portland Tourism Improvement District Sp.

If approved the sales and use tax referendum would establish a uniform sales tax rate of 275 percent within the city of Portland except where the sales tax rate is limited or. This rate is made up of a 65 state sales tax and a 10 local sales tax.

Kuow Washington And Oregon Have A Tax Off Who Wins

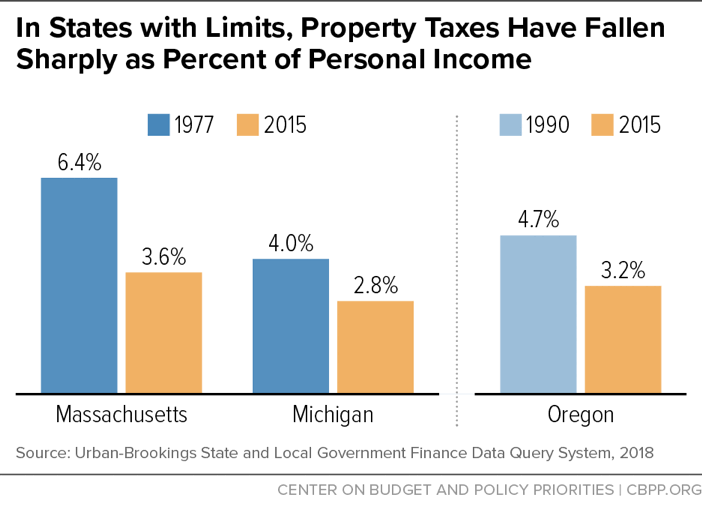

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Oregon Enacts Two New Local Income Taxes For Portland Metro Multnomah County Primepay

Buyers Find Tax Break On Art Let It Hang Awhile In Oregon The New York Times

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Ohio Sales Tax Rates By City County 2022

Sales Taxes In The United States Wikipedia

How High Are Corporate Income Tax Rates In Your State Tax Foundation Of Hawaii

High Earners In Portland Area Navigate Confusion Over New Personal Income Taxes Kgw Com

What Is The Real Cost Of Living In Portland 2022 Bungalow

Who Really Pays Economic Opportunity Institute Economic Opportunity Institute

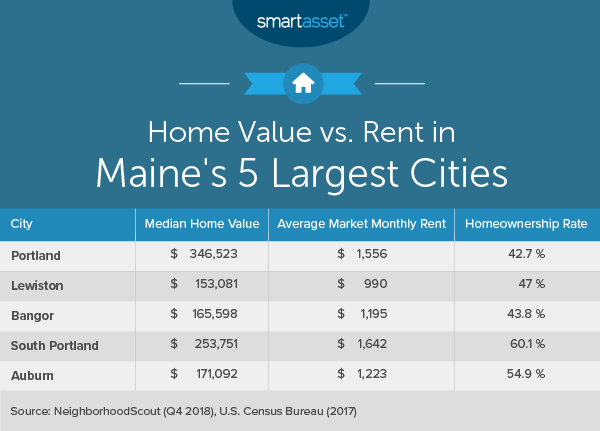

What Is The Cost Of Living In Maine Smartasset

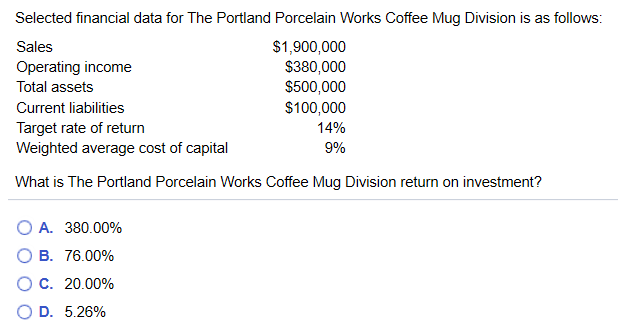

Solved Assume The Hiking Shoes Division Of The All About Chegg Com

Many High End New York Apartments Have Modest Tax Rates The New York Times

State Sales Tax Rates 2022 Avalara

How Two State Tax Systems Have And Haven T Shaped Metro Portland The Pew Charitable Trusts

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy